Markets in Crypto Assets

Preparing for the landmark EU regulation.

Authors

Figure 1: Number of CASP registrations per country

(as of 20/04/2023)

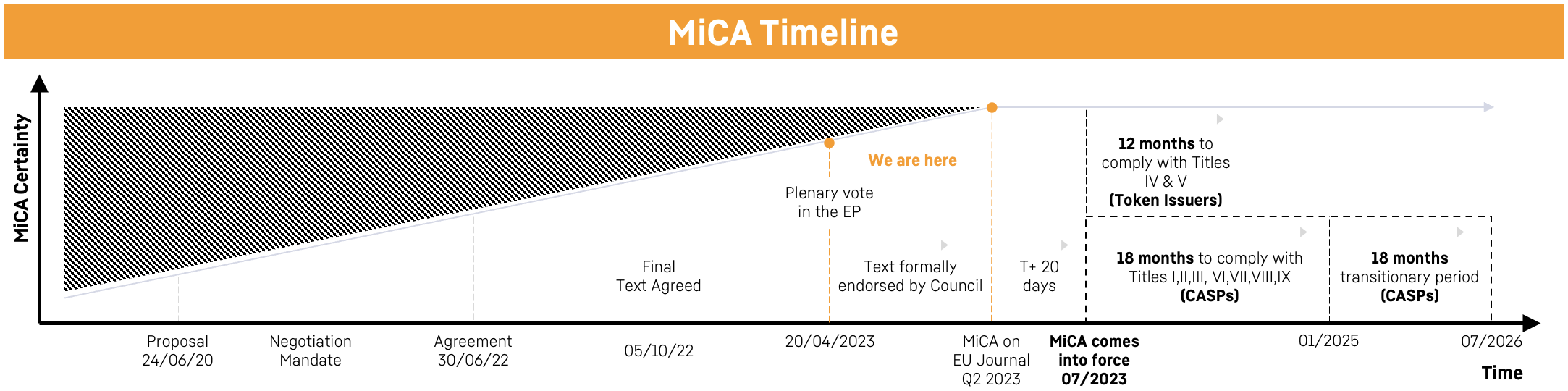

European Union lawmakers approved the landmark licensing law known as Markets in Crypto Assets (MiCA) in a plenary vote on 20 April 2023. Europe is now the first major global jurisdiction to install a comprehensive regulatory framework for the crypto sector, which represents an important step towards bringing greater clarity to the crypto asset market and service providers.

Prior to MiCA, Europe was a fragmented and uncertain environment for crypto-orientated firms, with over 50% of member states requiring their own, country-specific Crypto Asset Service Provider (CASP) registrations for CASPs to actively operate in that market.

MiCA regulation is the European Parliaments’ solution to the disjointed CASP registration process across EU member states. The legislation will reform Europe's stance on crypto assets and harmonise its regulatory approach across the entire EU jurisdiction.

MiCA will require all CASPs, including exchanges, wallet providers, and custodians, to obtain a license and comply with a range of requirements. These requirements aim to promote innovation while ensuring all CASPs are held to adequate operational, governance, prudential, and consumer protection standards.

Preparing for MiCA

Becoming compliant with MiCA will require organisation-wide efforts, which, depending on a firm's regulatory status and organisational readiness, may entail significant preparation and/or remediation. Firms seeking MiCA authorisation should act early and allocate sufficient time to ensure compliance and allow themselves to capitalise on strategic opportunities from being a first mover in achieving EU-wide authorisation. Preparing for MiCA regulation will require a proactive and thorough approach. Here are some steps CASPs can take to get ready:

Understand the MiCA text

CASPs must familiarise themselves with the comprehensive MiCA legislation, its nuanced scope, and operational requirements. Firms may wish to seek advice to ensure they fully understand the regulation and the requirements it imposes on them.

Gap analysis

Once a firm understands how MiCA applies to them, they must conduct a thorough readiness assessment in preparation for the legislation’s entry into application.

Licensing process preparation

For both existing firms, and new firms not yet regulated in Europe, the MiCA application process will involve assessing which member state to choose as its operational base and, thus, which competent authority (national financial supervisor) to seek MiCA authorisation from. This is an important decision for firms and should be assessed carefully across a range of criteria, including a firm's existing operations, regulatory status and relationships, language capabilities, and their strategic priorities (e.g., speed to market) as well as a country's regulatory perception and attitudes.

CASPs should begin preparing for the licensing process as soon as possible. They should ensure they have all the necessary documentation and information required for the license application and that they are prepared to demonstrate compliance with the regulation's requirements. Previous MiFID, Banking, and or EMI licence application experience is likely to give a firm an indication of the substance required to be authorised, although the finer details remain uncertain until official application and assessment processes are released.

Implementation programme mobilisation

Once crypto asset service providers have mapped MiCA's requirements to their firm and identified gaps in their compliance measures, they should mobilise a MiCA programme to implement any necessary changes to ensure they are fully compliant with the organisation-wide requirements.

Long-term strategic vision

The crypto service provider’s market is becoming increasingly crowded, and MiCA will level the playing field for those firms who achieve authorised status. An effective market strategy, product proposition, and long-term strategic vision are imperative. CASPs should embrace the reality of the competitive landscape and create a resilient strategy for a volatile market. Product innovation and revenue diversification can help decouple a firm’s performance from market conditions – lessening the dependency on crypto asset price appreciation.

How Valentia Partners can help

Our Fintech Consulting practice is assisting Financial Institutions and Crypto Exchanges to deliver transformation leveraging crypto technologies. Get in touch to find out more.

Valentia Partners supports crypto exchanges, custodians, and incumbent Financial Institutions to navigate this youthful industry and anticipate the evolving regulatory landscape. Operating at the intersection of Financial Services & FinTech, we bring together deep industry expertise and insights to shape incumbents’ innovation agenda and support Fintechs to scale and succeed.

We have helped CASPS successfully navigate towards EMI licences and EU CASP registrations (including the first-ever Central Bank of Ireland CASP approval). Additionally, Valentia has a depth of experience across Financial Services regulation, including MiFID II operational setups for large banking players.

MiCA is a new regulation with nuanced and discrete implications separate from other European regulatory frameworks that firms must also be cognisant of, including the existing EU AML/CFT, TFR, and MiFID II frameworks. Since the agreement of the final text, Valentia Partners has built a MiCA breakdown pack that synthesises the key strategic and operational considerations for firms and can help map the path to effective compliance. We detail MiCA’s origins, goals, rules for CASPs and token issuers, and our thoughts on MiCA’s impact on the European market landscape.

If you are a CASP wishing to succeed in the current crypto landscape and attain regulatory permissions underpinned by a growth-focused and robust operating model, reach out to one of the Valentia Partners team and ask about our MiCA readiness assessment.

Related Articles

An evolving macroeconomic climate poses a far greater risk to liquidity and idle cash than ever before, and treasuries must explore new ways to instil robust tools to provide sufficient liquidity and protect the underlying value of cash. And whilst this advice has existed for some time, the paradigm shift within treasury has now latched onto the broader technology capabilities on offer to drive real change.

Money market funds are ideal for treasuries given they are guided by a conservative mantra with capital preservation, daily liquidity and the added benefit of daily yields, delivering a powerful cash management tool. An enhanced repertoire to manage liquidity is becoming more desirable and money market funds fit neatly into the strategic objective of an increasing number of treasury operations.

In the modern fast-paced capital markets, every second counts. Imagine executing a trade in Frankfurt, affirming it in Luxembourg, and seeing assets delivered in a matter of hours.

That’s the promise of the emerging rollout of T+1 Settlement across the European Union and UK. Slated for full effect by October 2027, this regulatory leap doesn’t just align the European markets with heavyweight counterparts such as the US, Canada and India; it rewrites the pace and risk profile of securities trading across the entire continent.

Firms across Wealth Management are grappling with rapidly evolving client expectations, increasing regulatory complexity, and rising cost pressures – all while striving to scale and differentiate in an increasingly competitive marketplace.

Digital transformation shouldn’t be a one-off, it should be a core competency. With the right structure, firms can embed agility, accountability, and innovation across the organisation.

The European Union's proposed Payment Services Directive 3 (PSD3) and Payment Services Regulation (PSR) represent a significant evolution in the payments landscape for Financial Services. These changes aim to enhance security, foster innovation, and level the playing field between traditional banks and non-bank payment service providers (PSPs), ultimately delivering greater protection, choice and convenience for the customer.

The evolving regulatory landscape under PSD3 and PSR presents both significant challenges and unique opportunities for Bank PSPs, requiring a proactive, innovation-led response to remain competitive and retain or grow customer relationship primacy.

ERP consolidation plays a fundamental role in creating value throughout the investment lifecycle, allowing firms to reduce costs and enhance commercial offerings with future-proofed and scalable capability. However, post-merger, companies often inherit multiple systems performing similar functions, creating friction to maximising value through the buy-and-build approach.

The financial services industry is at a pivotal point in time. What was once built on face-to-face meetings, extensive paperwork, and manual processes is now being rapidly reshaped by digitisation. Consumers expect seamless digital experiences in every aspect of their lives—banking, shopping, healthcare, and now, wealth management. This shift is redefining customer expectations, rendering traditional performance metrics obsolete, and fundamentally altering what drives profitability.

The Fundamental Review of the Trading Book (FRTB) is a set of regulatory standards developed by the Basel Committee on Banking Supervision (BCBS) as a part of its broader Basel III framework. FRTB aims to address shortcomings in the existing trading book framework, enhance risk management practices, and ensure that banks hold sufficient capital against their risk exposures. In this paper, we will be addressing the new FRTB rule, what it is, and its impact on organisations.

Horizon technology is driving a recalibration across financial services. Guided by a need to drive efficiency, firms are scrambling to maintain pace with competitors - or innovate beyond them. The integration of these technologies enhances productivity, mitigates operational risk and creates new opportunities for financial institutions. Failure to adopt horizon technologies could result in a loss of competitive edge and increasing inefficiencies across the enterprise over time. To achieve long term resilience and growth, organisations must take these technologies seriously and begin formulating ways to implement them across the business.

Imagine a future where any asset - whether real estate, art, or equities - is accessible to anyone, breaking barriers like geography, wealth, and institutional gatekeeping. Tokenisation is making this possible by converting assets into digital tokens that are easily transferable and universally accessible.

As the financial industry undergoes rapid transformation, modernising core banking systems is no longer optional - it’s a necessity. With many banks still operating on legacy systems, some of which were implemented 30 to 40 years ago, these aging platforms, often heavily customised, struggle to keep pace with the demands of digital banking, real-time transactions, and seamless integration with fintech partners.

Several months following its publication, this paper examines ESMA’s 31 July opinion issued to National Competent Authorities (NCAs) and considers the impacts it is having on those seeking to operate within the parameters of Europe’s Markets in Crypto Assets Regulation (MiCAR). We assess how ESMA's guidance is reshaping the landscape for broker-dealer models, and how best execution requirements will require firms to make operational changes in a rapidly evolving regulatory environment.

In today's rapidly evolving geopolitical landscape, the banking sector faces an unprecedented increase in the risk of money laundering and financial crime. As the first line of defence against these threats, banks must confront the harsh reality that their existing KYC (Know Your Customer) and AML (Anti-Money Laundering) processes are being tested like never before. The heightened risk environment necessitates an urgent call to action. Now is the time to invest in innovative technology and develop a fit-for-purpose operating model. To reinforce defences to ensure they stay ahead of emerging threats as well as be a pioneer for further essential business growth.

Realising the future CFO office to drive continuous improvement is a key vector for unlocking outsized value creation and increasing market competitiveness.

As the importance of technology in business operations deepens, the CFO and finance function should be attributed remits across controlling the tech. spend agenda, owning financial / operational data, and acting as a facility for insights – evolving into a more complex role within businesses as the strategic engine room.

SEPA Instant was introduced as a key component of the Single Euro Payments Area initiative, addressing the need for a pan-European Euro instant payment solution. It represents a significant evolution in European Banking, aimed at enabling real-time, cross-border Euro transactions. This system significantly enhances the efficiency of transactions, offering a faster, more streamlined payment process across Europe with enhanced data capabilities – crucial in the modern financial ecosystem.

CRD VI is anticipated to come into effect Jan 2027, meaning third country banks can no longer provide in-scope cross-border banking services to EU clients. The current near-final text; i) increases regulatory scrutiny across capital requirements, facilitating further oversight from national competent authorities (NCAs) of third country banks, and ii) introduces a mandatory subsidiarisation criteria of third country branches (TCBs).

For third country banks, building a a robust response to CRD VI requires evaluation and design across entity structures, technology platforms and, operating model – with key consideration of broader regulatory / compliance impact resulting from changes in operating structure.

The PRA published the supervisory statement SS 2/24 in March 2024 where it set out the new rules and expectations for non-systemic banks and building societies. The proposed Solvent Exit exercise expects the firms in scope to make preparations for ‘Solvent Exit’ as part of their BAU activities. The crux of the regulation is: orderly wind down after returning or transferring deposits and cancellation of the Part 4A PRA permission.

Financial Services firms face global economic pressures, including fluctuating interest rates, geopolitical tensions, and stringent regulatory requirements. Rapid technological advancements like Blockchain and Generative Artificial Intelligence (Gen Al) add to the complexity of the landscape. To thrive, firms must set ambitious strategic goals, building on a foundation of operational excellence to innovate and remain competitive. It has never been more difficult for those in charge of operations to know where to place their bets. With this whitepaper we aim to simplify all of that.

Valentia Partners evaluates the challenges associated with implementing the Trading Activity Wind Down (TWD) requirements outlined in the PRA’s Supervisory Statement SS1/22 of May 2022, with a focus on meeting the regulation deadline of March 2025. We also explore enhancements for any potential post-implementation Book of Work (BoW); and suggest areas where regulatory forbearance from the PRA could be sought.

The FCA’s new Consumer Duty regulation has had a profound impact on the financial services market since it’s go-live in July-23. Valentia Partners takes a look at some of the challenges firms have faced since Day 1, what is required to implement effective monitoring and reporting processes, and how firms can future-proof procedures to ensure they act in the interests of their consumers in the future.

Valentia Partners takes a closer look at recent sustainability requirements that may have implications for Financial Services businesses and their clients. On the 28th of November 2023, the UK Financial Conduct Authority (FCA) published the Sustainability Disclosure Requirements (SDR). This policy aims to address risks of ‘greenwashing’ and enhance transparency across sustainable investments.

Entry Strategies for Traditional Firms.

Three tokenization solutions attracting investment.

Approaching the Consultation Packages.

Six indicators that signal the direction of digital asset adoption.

Environment, Social and Governance are a sometimes-uncomfortable juxtaposition of ideas. Collectively they speak to sustainability and catalyse change across the operating models of Financial Services business. Here we discuss how to engage, prioritise and deliver ESG-inspired change in Financial Services.

Financial Services customers will each have their own ideas as to how ESG should be factored into the service they receive. Standard customer journeys cannot accommodate this. We address what needs to change.

ESG is an industry changing opportunity to embrace sustainability and access new, long-term value pools. It’s also an enormous challenge for Data and Analytics capabilities.

Upcoming UK ESG regulation may be the most important shift yet for authentically sustainable finance.

The combined effects of climate change, socio-economic change, and the shift towards a more credit driven economy expose lenders to greater and more diverse risks than ever before. ‘ESG’ provides a framework that enables sustainability analysis.

Preparing for the landmark EU regulation.