Harnessing the potential of ESG data

ESG is an industry changing opportunity to embrace sustainability and access new, long-term value pools. It’s also an enormous challenge for Data and Analytics capabilities.

Downloads

Authors

Seizing the ESG Opportunity through Data and Analytics

Figure 1 - Relative popularity of ESG and Greenwashing search terms on Google (via Google Trends).

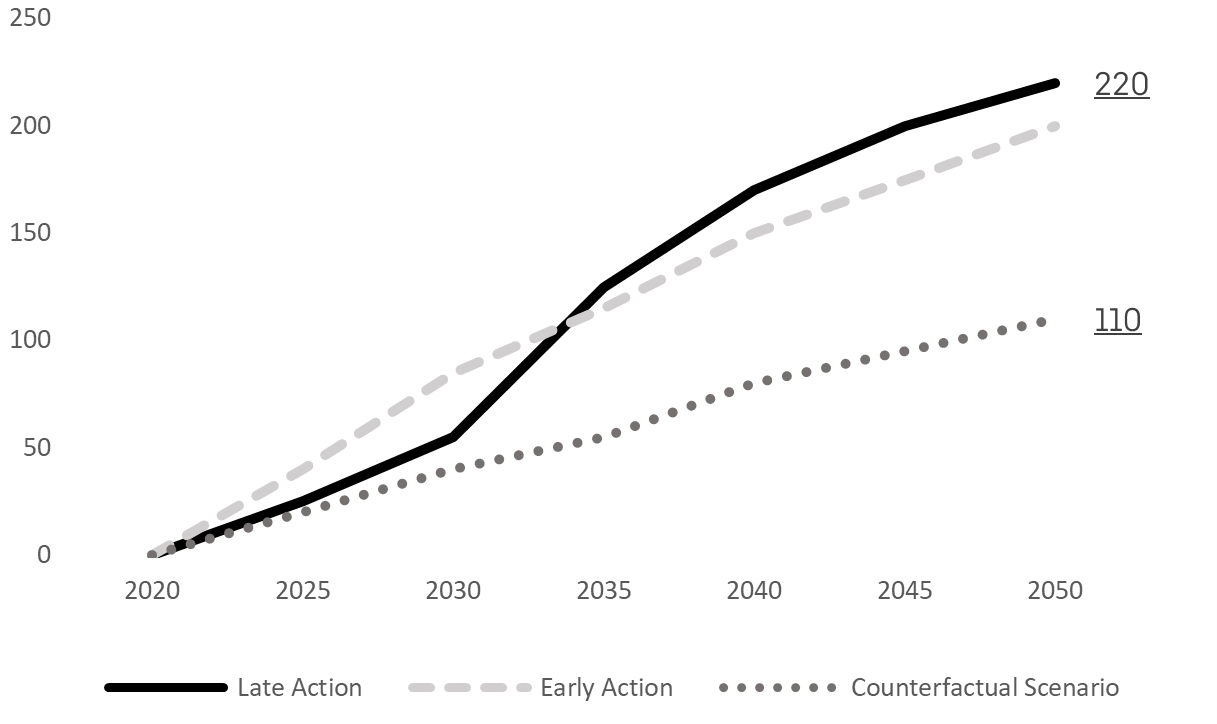

Figure 2 - Projected bank losses (Billions GBP) were highest in the late action scenario.

Figure 3 - Responses from various CEOs on ESG compiled by the United Nations, where 2021 responses were indexed to 100.

Financial Institutions have large, complex, and often under-structured data sets. Will they be ready to handle the growing scale and importance of ESG data?

Why is ESG data different?

Financial Institutions (FIs) are looking carefully at their products and processes to address the Environmental, Social and Governance (ESG) needs and impacts of their business. Stakeholders are demanding more, forcing FIs to get more out of their data to satisfy stakeholders' growing ESG needs.

FIs need to ingest a greater volume of more diverse data points to understand how they measure up. They need more from their analytics to spot opportunities and they must be prepared to create and distribute ESG reporting to satisfy internal and external stakeholders. They will also need unprecedented level of creativity if they are to carve out a competitive advantage around ESG.

Valentia Partners have identified five drivers of change in the ESG data landscape. We'll unpack them here and go on to discuss how we can support FIs in staying ahead of the curve on ESG data.

1. Growing regulatory attention & demands

National and Supra-national Governments are concerned with sustainability in their financial services sectors and demanding evidence of progress.

Both the UK and European regulators have introduced ESG reporting guidelines including Task Force on Climate-related Financial Disclosures (TCFD), Streamlined Energy and Carbon Reporting (SECR) and the European Banking Authority’s (EBA) Pillar 3 disclosures alongside the Sustainability Disclosure Requirements (SDR) and Sustainable Finance Disclosure Regulation (SFDR) governing ESG products.

Failure to comply with these regulations will result in penalties. Higher quality data and data management are critical to achieving compliance.

2. Rapidly changing investor preferences

Investors, customers and stakeholders have higher expectations of financial institutions where it comes to sustainability. They expect products and businesses to be managed with an eye on ESG risks and sustainability opportunities. A survey by Deutsche Bank in 2021 found that 70% of UK institutional investors would withdraw investments from companies with poor ESG performance.

Additionally investors expect a higher level of transparency and reporting. Figure 1 illustrates the growth in investor awareness of "Greenwashing" which can be directly linked to growth in interest in ESG products and services. It's not enough for financial institutions to make ESG claims any more, they have to be backed up by properly sourced, processed and reported data.

3. Greater comprehension of material ESG risks

Failure to address ESG risks can result in financial losses for financial services firms.

For example, the Bank of England estimates that a "Late Action" to addressing ESG and climate change risks could cause a substantial rise in bank credit losses. Loss rates would more than double, resulting in approximately £110 billion in extra losses over the long-term compared to their "Counterfactual" scenario. Refer to Figure 2 for a visual representation of the projected losses. Banks that fail to manage this risk to their loan books will lose money to widespread defaults. Data are critical to anticipating and mitigating climate change risks.

4. FIs are competing in new, ESG value pools

Integrating ESG factors and reporting on them will be critical to finding and penetrating valuable market segments.

The 2022 UN Global Compact survey charted a 10% rise in CEOs who see investors greatly impacting a company's ESG strategy (Figure 3). ESG's increasing strategic importance could have a significant impact on a firms' access to credit and ultimately, their ability to operate.

ESG is increasingly seen as a differentiator amongst FIs. Some FIs will need strategies for how to deal with burgeoning ESG requirements, whilst others will look at investments in ESG products and services as strategic enablers.

Creating and supporting ESG strategies requires the ability to analyse and interpret data relating to the external impact of a firm's operations. Handling this complexity and building strong analytics capabilities will be the difference between sink and swim.

5. Challenges with the supply of ESG data

ESG data measures the externalities of business activities. Today, processing a varied and diverse set of data into usable scores and ratings relies on a small handful of data supply chains and a large amount of self-reported data. FIs face challenges in differentiating their ESG insights given the consolidation effect of this global data pipeline.

The commodification of ESG scores in the Financial Services (FS) industry can be counter-productive for organisations looking to focus on specific issues. Aggregated, "ESG scoring" approaches do not necessarily meet the needs of the most sustainability-focussed organisations.

FIs looking to differentiate themselves in the ESG space may set out to integrate alternative, primary data sources into their ESG analytics. Indeed, many already have. To do so they must overcome the complexity of supporting primary data gathering, engineering and analysis alongside the management of traditional FS data feeds. Proprietary data feeds and analytics will become the foundation for competitive advantage in the ESG space. As such this data should be treated as the asset it is and any cyber-security vulnerabilities need to be comprehensively addressed at both network and data-store levels.

Delivering against these ESG data challenges will be an ongoing effort. However, if they are approached strategically, the shift towards ESG is a fantastic opportunity. FIs that properly integrate ESG data will uncover new commercial, operational, and reputational opportunities.

Why is it so difficult to get ESG Data right?

Not all FIs will benefit from the ESG data opportunity. Even the best data teams and the savviest Chief Data Officer will be challenged by extracting value from ESG data.

External challenges such as a lack of standardisation and low data accuracy in commercial feeds may compromise data quality. Internal challenges resulting from manual processes such as data handling and management can drive up the costs of engaging with ESG data and hamper attempts to achieve usable insights.

Lack of standardisation

The industry, regulators, ESG index providers and customers all have their own idea and interpretation of what ESG means. ESG data reporting varies across the board as different formats and metrics are being used.

Inconsistent data quality and methodologies across multiple providers create difficulties in comparing different ESG data sets, like comparing apples to oranges.

Inherent complexity of non-financial data

ESG data is different to traditional, financial data. Many ESG data points are currently only captured qualitatively. Some ESG factors cannot be quantified. Whilst carbon emissions can be measured and recorded in structured data sets, there are numerous ways to measure factors such as diversity and inclusion, for instance.

Reporting requirements vary across industries and geographies, so market-specific data is often patchy or non-existent making it difficult to assess some issuers' ESG performance. FIs may be faced with the dilemma of either disengaging from certain instruments because supporting ESG data is not available or to use alternative, less reliable data sources as a proxy.

Inaccuracies and misunderstandings

ESG data remains relatively new as an input into an FI's decision-making processes. FIs have not yet had the opportunity, to build robust data validation processes to catch errors or misreporting. This creates a risk of inaccurate data from issuers forming part of ESG decisions.

Most ESG data relies upon self-reported measurements creating a risk that FIs are misled by accidental errors or "greenwashing" claims made by issuers. The vast majority of commercially available ESG scores and analyses are taken directly from company annual reports and aggregated for analysis. Given the pace of change, customers will soon demand ESG analytics on a more regular basis to increase the resolution and quantity of insights. As such, the regularity and resolution of ESG data needs to increase too.

Challenges handling sensitive data at scale

There is a risk that mishandling data could undermine FIs' efforts to integrate ESG data into their operations. Mishandling sensitive, private or proprietary data could result in fines and reputational damage.

Historically, data providers have communicated data in flat files over SFTP connections or similar data pipelines. As the complexity of data required for ESG use cases outstrips conventional data sources FIs will need to fortify their data engineering capabilities in terms of both tooling, personnel and security. Data is at risk both in transit and at rest.

Cloud technologies, AI powered data aggregation tools and enhanced security apparatus are all providing solutions to these challenges. FIs must invest appropriately in these capabilities to protect and exploit their data assets.

Tactical fixes exceeding strategic planning

Managing data can be time-consuming and resource-intensive if data is scattered across multiple, discrete databases. This situation tends to occur when business lines are left up to their own devices to solve for their data challenges without a central, strategic command-and-control.

Managing data effectively requires careful, strategic planning. It is a waste of resources to build data solutions that are manual, rigid, and unscalable and expect them to meet the efficiency and governance requirements of the organisation. Starting with requirements and establishing a common, ESG data strategy at enterprise level is a key mitigant to the risk of becoming dependent on tactical fixes.

FIs need to ensure that they start with 'why' when considering how to approach ESG data. The organisation's policies and attitudes towards sustainability in their operations and product set will be the guiding input into a data strategy that will serve those requirements.

Case Study: ISO20022 Payments Data

The Opportunity:

The ISO20022 standard is becoming law and Valentia Partners is migrating Banks' payments platforms to become ISO20022-compliant.

This new payments message standard offers the opportunity to capture a more information from every payment sent or received.

Enriched payments data could be used to provide feedback to customers on their carbon impact and incentivise 'good' behaviours whilst discouraging 'bad' ones.

The Challenge:

Financial services organisations are encountering this richer data for the first time and don't necessarily have plans for how to use it. Amongst fraud prevention, AML and customer experience there is a danger that ESG applications are lost.

Integrating and processing these new payments messages requires upgraded technology and changes to downstream data and analytics capabilities. These must compete for resource with other data initiatives.

The Solution:

Defining the importance of ESG to the Bank's strategy will prioritise ESG applications against others and ensure appropriate resourcing.

How do you get ESG Data Right?

Figure 4: The sensible approach to tackle ESG data requires both strategic planning and implementation excellence.

Without an ESG data strategy, it is likely that FIs will struggle to put together a cohesive set of data solutions that meet enterprise requirements. As such, their technology, and processes for ESG will be unable to efficiently handle the increased stresses of customer, regulator, and internal demands in the long-term. FIs need a balance of strategy and implementation to overcome the challenges surrounding ESG data.

Strategy: Define ESG Outcomes and Data Support

Working with stakeholders and enterprise level analytics take the time to lay out the organisation's ambitions for ESG.

Data strategy should always serve business strategy and as such, the most important question is, 'what does the business want to achieve with regard to ESG?'. FIs must define an ESG strategy based on requirements aligned with stakeholder expectations and commercial ambitions.

Strategy: Assess Your Starting Point

Relative to those business-level ESG requirements, assess the data and analytics required to achieve them. Bear in mind that the mix of internally sourced data and data ingested from 3rd party sources should be considered at this early stage.

Define data storage requirements and evaluate if capabilities are adequate taking factors such as flexibility, security, and accessibility into account.

Review and evaluate existing technology solutions and identify whether they've historically contributed to data silos that need to be broken for ESG purposes.

Strategy: Source Data Internally & Externally

It's likely that existing proprietary data needs work to make it sufficiently fungible for ESG use cases. Collect, clean, and format internal data to align with ESG strategy.

Where existing data is insufficient to meet organisational needs, assess and evaluate external data vendors. Consider 'how' the vendors are producing their data as well as 'what' they can provide.

For FIs with ESG centric strategies, it may be wise to maximise the benefits of ESG data. These FIs should also explore sourcing data from alternative providers or gathering primary data. This approach empowers FIs to use multiple inputs to improve the reliability and the quality of their analyses.

Evaluate compatibility, volume, and structure of data to select optimal transmission mechanism for seamless integration. Building out APIs or exploring streaming data capabilities may be beneficial to FIs seeking to maximise their use of high-fidelity data sources.

Implementation: Data Ingestion & Integration

Matching data to an ESG strategy requires the flexibility to build analyses that draw on multiple, divergent data resources. This makes data integration and availability key to long term success. Develop a comprehensive technology strategy to seamlessly integrate ESG data into existing functions and fit this within an enterprise-wide framework.

Ensure accurate data mapping and optimise for uninterrupted data flows between different systems.

Implementation: Analytics Capabilities

Matching the level of analysis to the complexity of the strategy is critical to efficiently achieving it.

For some the strategy will be to comply with regulators and no more. In these cases may be enough to 'pipe' 3rd party ratings straight through to reporting - very little additional analysis is required.

For those looking for competitive advantages in ESG, the ability to build and act on both ad-hoc and on-going analyses will be critical. As such a more detailed analysis of existing tech and data will stand these organisations in good stead.

Harness technologies such as RPA, and machine learning, and statistical techniques through vendor tools to meet your ESG objectives, building tooling only where absolutely necessary.

Implementation: Deliver Efficient Reporting

Whether the strategy is simply compliance or one of robust and active participation in sustainability-led initiatives, it will be critical to be able to produce reporting on ESG data fields and analyses with minimal overhead. Runaway reporting costs can undermine the success of a data-led strategy.

Establish process for compliant reporting of ESG data using standardised frameworks.

Utilise dashboards and mobile apps to deliver real-time, user-friendly ESG investment disclosures to customers and stakeholders.

Create processes and controls around the transparency and accessibility of the ESG data.

Achieving a robust and capable ESG data function requires careful planning, an eye on scalability and a focus on compliance. Effective partners can be game-changing in overcoming the hurdles.

How can Valentia Partners help?

To discover more or talk to us about anything you've read here please don't hesitate to get in touch.

The FS industry has achieved significant advancements in its data and analytics capabilities in recent years. The ability to effectively use data has become a crucial competitive advantage, resulting in increased investment and a strong pull on highly skilled data professionals.

Nonetheless, the effectiveness of these highly skilled and well-funded capabilities is frequently undermined by a lack of coherence between strategy and implementation. Achieving effective execution of data and analytics solutions becomes very challenging when FIs don't agree on what they are trying to achieve.

ESG is the most recent illustration of this, highlighting the need for businesses to take the lead in guiding data teams, establishing agendas, and ensuring cohesive requirements. Valentia Partners specialises in bridging the gap between enterprise-level strategies, and the frontline teams responsible for executing them.

Valentia Partners is a Management Consultancy specialising in helping FIs and FinTechs navigate strategic transformation in the Financial Services Industry. We work across the industry with buy- and sell-side clients as well as technology providers and disruptors. Instead of a cookie-cutter approach, we provide bespoke, tailored solutions through our:

In-house Expertise: We have a team of experienced professionals who specialise in regulatory data compliance, data architecture, engineering, and analytics.

Regulatory Insights: We have a deep understanding of the ever-changing regulatory landscape, and its latest developments.

Implementation Network: We support FIs in transitioning from "thought to execution" through our diverse partnership network, which encompasses all required skillsets.

Industry Experience: We have been active in the Financial Services sector since 2006. We've been through good times and bad, mitigating the fall-out of 2008 and building through the FinTech boom that followed. We've seen most things before.

To find out more or talk to us about anything you have read here please do not hesitate to get in touch using ValentiaPartners.com or the contact Information that follows.